Following Benford's Law, or Looking Out for No. 1

By Malcolm W. Browne

(From The New York Times, Tuesday, August 4, 1998)

Dr. Theodore P. Hill asks his mathematics students at the Georgia Institute of

Technology to go home and either flip a coin 200 times and record the results,

or merely pretend to flip a coin and fake 200 results. The following day he runs

his eye over the homework data, and to the students' amazement, he easily

fingers nearly all those who faked their tosses.

"The truth is," he said in an interview, "most people don't know the real

odds of such an exercise, so they can't fake data convincingly."

There is more to this than a classroom trick.

Dr. Hill is one of a growing number of statisticians, accountants and

mathematicians who are convinced that an astonishing mathematical theorem known

as Benford's Law is a powerful and relatively simple tool for pointing suspicion

at frauds, embezzlers, tax evaders, sloppy accountants and even computer bugs.

The income tax agencies of several nations and several states, including

California, are using detection software based on Benford's Law, as are a score

of large companies and accounting businesses.

Benford's Law is named for the late Dr. Frank Benford, a physicist at the

General Electric Company. In 1938 he noticed that pages of logarithms

corresponding to numbers starting with the numeral 1 were much dirtier and more

worn than other pages.

(A logarithm is an exponent. Any number can be expressed as the fractional

exponent -- the logarithm -- of some base number, such as 10. Published tables

permit users to look up logarithms corresponding to numbers, or numbers

corresponding to logarithms.)

Logarithm tables (and the slide rules derived from them) are not much used for

routine calculating anymore; electronic calculators and computers are simpler

and faster. But logarithms remain important in many scientific and technical

applications, and they were a key element in Dr. Benford's discovery.

Dr. Benford concluded that it was unlikely that physicists and engineers had

some special preference for logarithms starting with 1. He therefore embarked on

a mathematical analysis of 20,229 sets of numbers, including such wildly

disparate categories as the areas of rivers, baseball statistics, numbers in

magazine articles and the street addresses of the first 342 people listed in the

book "American Men of Science." All these seemingly unrelated sets of numbers

followed the same first-digit probability pattern as the worn pages of logarithm

tables suggested. In all cases, the number 1 turned up as the first digit about

30 percent of the time, more often than any other.

|

|

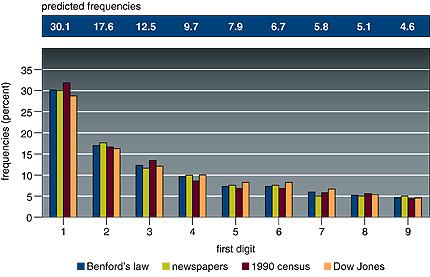

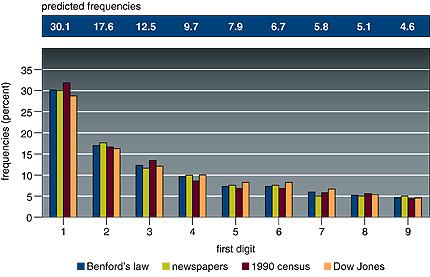

(From "The First-Digit Phenomenon" by T. P. Hill, American Scientist, July-August 1998)

Benford's law predicts a decreasing frequency of first digits,

from 1 through 9. Every entry in data sets developed by Benford for numbers

appearing on the front pages of newspapers, by Mark Nigrini of 3,141 county

populations in the 1990 U.S. Census and by Eduardo Ley of the Dow Jones

Industrial Average from 1990-93 follows Benford's law within 2

percent. |

|

Dr. Benford derived a formula to explain this. If absolute certainty is defined

as 1 and absolute impossibility as 0, then the probability of any number "d"

from 1 through 9 being the first digit is log to the base 10 of (1 + 1/d). This

formula predicts the frequencies of numbers found in many categories of

statistics.

Probability predictions are often surprising. In the case of the coin-tossing

experiment, Dr. Hill wrote in the current issue of the magazine American

Scientist, a "quite involved calculation" revealed a surprising probability. It

showed, he said, that the overwhelming odds are that at some point in a series

of 200 tosses, either heads or tails will come up six or more times in a row.

Most fakers don't know this and avoid guessing long runs of heads or tails,

which they mistakenly believe to be improbable. At just a glance, Dr. Hill can

see whether or not a student's 200 coin-toss results contain a run of six heads

or tails; if they don't, the student is branded a fake.

Even more astonishing are the effects of Benford's Law on number sequences.

Intuitively, most people assume that in a string of numbers sampled randomly

from some body of data, the first non-zero digit could be any number from 1

through 9. All nine numbers would be regarded as equally probable.

But, as Dr. Benford discovered, in a huge assortment of number sequences --

random samples from a day's stock quotations, a tournament's tennis scores, the

numbers on the front page of The New York Times, the populations of towns,

electricity bills in the Solomon Islands, the molecular weights of compounds the

half-lives of radioactive atoms and much more -- this is not so.

Given a string of at least four numbers sampled from one or more of these sets

of data, the chance that the first digit will be 1 is not one in nine, as many

people would imagine; according to Benford's Law, it is 30.1 percent, or

nearly one in three. The chance that the first number in the string will be 2 is

only 17.6 percent, and the probabilities that successive numbers will be the

first digit decline smoothly up to 9, which has only a 4.6 percent chance.

A strange feature of these probabilities is that they are "scale invariant" and

"base invariant." For example, it doesn't matter whether the numbers are based

on the dollar prices of stocks or their prices in yen or marks, nor does it

matter if the numbers are in terms of stocks per dollar; provided there are

enough numbers in the sample, the first digit of the sequence is more likely to

be 1 than any other.

The larger and more varied the sampling of numbers from different data sets,

mathematicians have found, the more closely the distribution of numbers

approaches what Benford's Law predicted.

One of the experts putting this discovery to practical use is Dr. Mark J.

Nigrini, an accounting consultant affiliated with the University of Kansas who

this month joins the faculty of Southern Methodist University in Dallas.

Dr. Nigrini gained recognition a few years ago by applying a system he devised

based on Benford's Law to some fraud cases in Brooklyn. The idea underlying his

system is that if the numbers in a set of data like a tax return more or less

match the frequencies and ratios predicted by Benford's Law, the data are

probably honest. But if a graph of such numbers is markedly different from the

one predicted by Benford's Law, he said, "I think I'd call someone in for a

detailed audit."

|

|

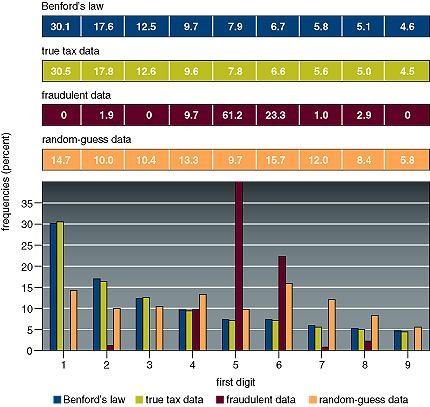

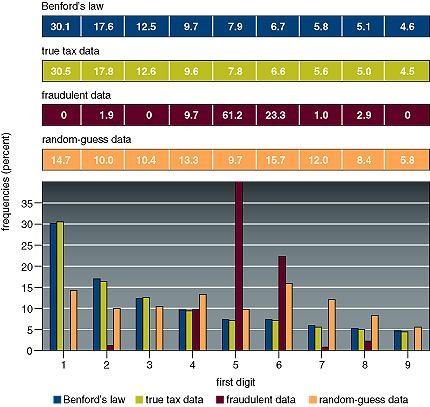

(From "The First-Digit Phenomenon" by T. P. Hill, American Scientist, July-August 1998)

Benford's law can be used to test for fraudulent or

random-guess data in income tax returns and other financial reports. Here the

first significant digits of true tax data taken by Mark Nigrini from the lines

of 169,662 IRS model files follow Benford's law closely. Fraudulent data taken

from a 1995 King’s County, New York, District Attorney's Office study of cash

disbursement and payroll in business do not follow Benford's law. Likewise, data

taken from the author's study of 743 freshmen's responses to a request to write

down a six-digit number at random do not follow the law. Although these are very

specific examples, in general, fraudulent or concocted data appear to have far

fewer numbers starting with 1 and many more starting with 6 than do true

data. |

|

Some of the tests based on Benford's Law are so complex that they require a

computer to carry out. Others are surprisingly simple; just finding too few

ones and too many sixes in a sequence of data to be consistent with Benford's

Law is sometimes enough to arouse suspicion of fraud.

Robert Burton, the chief financial investigator for the Brooklyn District

Attorney, recalled in an interview that he had read an article by Dr. Nigrini

that fascinated him.

"He had done his Ph.D. dissertation on the potential use of Benford's Law to

detect tax evasion, and I got in touch with him in what turned out to be a

mutually beneficial relationship," Mr. Burton said. "Our office had handled

seven cases of admitted fraud, and we used them as a test of Dr. Nigrini's

computer program. It correctly spotted all seven cases as "involving probable

fraud."

One of the earliest experiments Dr. Nigrini conducted with his Benford's Law

program was an analysis of President Clinton's tax return. Dr. Nigrini found

that it probably contained some rounded-off estimates rather than precise

numbers, but he concluded that his test did not reveal any fraud.

The fit of number sets with Benford's Law is not infallible.

"You can't use it to improve your chances in a lottery," Dr. Nigrini said. "In a

lottery someone simply pulls a series of balls out of a jar, or something like

that. The balls are not really numbers; they are labeled with numbers, but they

could just as easily be labeled with the names of animals. The numbers they

represent are uniformly distributed, every number has an equal chance, and

Benford's Law does not apply to uniform distributions."

Another problem Dr. Nigrini acknowledges is that some of his tests may turn up too

many false positives. Various anomalies having nothing to do with fraud can

appear for innocent reasons.

For example, the double digit 24 often turns up in analyses of corporate

accounting, biasing the data, causing it to diverge from Benford's Law patterns

and sometimes arousing suspicion wrongly, Dr. Nigrini said. "But the cause is

not real fraud, just a little shaving. People who travel on business often have

to submit receipts for any meal costing $25 or more, so they put in lots of claims

for $24.90, just under the limit. That's why we see so many 24's."

Dr. Nigrini said he believes that conformity with Benford's Law make it possible

to validate procedures developed to fix the Year 2000 problem -- the expectation that

many computer systems will go awry because of their inability to distinguish the

year 2000 from the year 1900. A variant of his Benford's Law software already in

use, he said, could spot any significant change in a company's accounting

figures between 1999 and 2000, thereby detecting a computer problem that might

otherwise go unnoticed.

"I foresee lots of uses for this stuff, but for me its

just fascinating in itself," Dr. Nigrini said. "For me, Benford is a great hero.

His law is not magic, but sometimes it seems like it."

Dow Illustrates Benford's Law

To illustrate Benford's Law, Dr. Mark J. Nigrini offered this example:

"If we think of the Dow Jones stock average as 1,000, our first digit would be 1.

"To get to a Dow Jones average with a first digit of 2, the average must increase to 2,000, and getting from 1,000 to

2,000 is a 100 percent increase.

"Let's say that the Dow goes up at a rate of about 20 percent a year. That means that it would take five years to get

from 1 to 2 as a first digit.

"But suppose we start with a first digit 5. It only requires a 20 percent increase to get from 5,000 to 6,000, and that

is achieved in one year.

"When the Dow reaches 9,000, it takes only an 11 percent increase and just seven months to reach the 10,000

mark, which starts with the number 1. At that point you start over with the first digit a 1, once again. Once again,

you must double the number -- 10,000 -- to 20,000 before reaching 2 as the first digit.

"As you can see, the number 1 predominates at every step of the progression, as it does in logarithmic

sequences."

|

You are visitor

![[Odometer]](/cgi-bin/countrex.cgi?benford) since 26 October 1999

since 26 October 1999

Rex Swain,

E-mail rex@rexswain.com,

Web www.rexswain.com